What Price Should OSK Holdings Worthy of?

What price should OSK Holding Berhad worthy of? Because there are no guidance reports from any analysts, let do some simple mathematics calculation.

Based on the market price of cause it's just RM 0.955 per share of market cap of about RM 2 billions with a price earning ratio PE of 5.13 and NTA of RM 2.3.

It's seem to be a very simple mathematics right?

But what if there are some third parties or capital investment companies today announce that they want to have full acquisition of the whole business of OSK Holdings Berhad and making it private.

Then, at what price should OSK Holding Berhad worthy of?

um

The third parties willingness to pay a full acquisition offer of premium offer price or more than 150% of the market price of RM 1.50 per share of about a capital purchased RM 3 billions cash to own the whole OSK businesses.

Are you willing to accept the deal? Is the offer price reasonable or fair?

How about whether the major shareholders willing to sell at this price?

I think you know the answer as very smart investors.

Obviously it's still cheap and undervalue even it's at RM 1.50 per share in which the adjusted PE about 8 and NTA RM 2.3 with an equity value of more than RM 4.85 billion.

So, at what price is most of the small shareholders willing to sell?

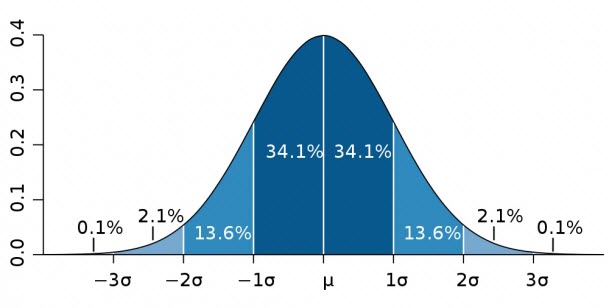

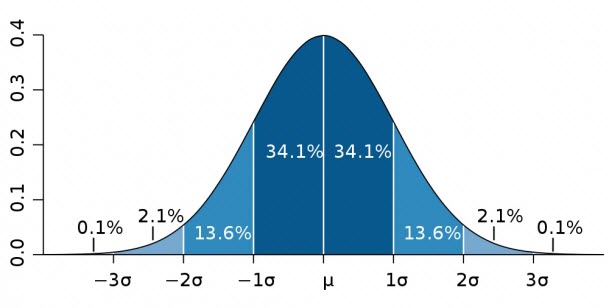

Based on a normal market movement and simple statistical calculation of let said normal distribution, about 50% of the small shareholders will sell at a price of RM 1.6, about 84% the small shareholders will sell at RM 1.83 and about 97% will sell at RM 2.06. Only remain about 2% will sell at RM 2.3 and 0.1% will sell if offer more than RM 2.3.

At what price will you likely to buy or sell then?

How about the major shareholder???, at what price should OSK Holding Berhad worthy?

How about the third parties willingness to pay a full acquisition offer of premium offer price of RM 2.30 per share of about a capital purchased RM 4.8 billions cash to own the whole OSK businesses?

Accept or deal?

Again as very smart investors, I think you know the answer.

How about at RM 3 offer of RM 6.285 billions in cash?

Look attractive right??? with a PE of 16, maybe reasonable, but also possible normally in businesses full acquisition with 1.5 x of NTA of RM 3.45 offer of RM 7.2 billions in cash that the major shareholder will laugh at you and say thank you and will look into the offer and give you an answer later.

What say you?

Based on the market price of cause it's just RM 0.955 per share of market cap of about RM 2 billions with a price earning ratio PE of 5.13 and NTA of RM 2.3.

It's seem to be a very simple mathematics right?

But what if there are some third parties or capital investment companies today announce that they want to have full acquisition of the whole business of OSK Holdings Berhad and making it private.

Then, at what price should OSK Holding Berhad worthy of?

um

The third parties willingness to pay a full acquisition offer of premium offer price or more than 150% of the market price of RM 1.50 per share of about a capital purchased RM 3 billions cash to own the whole OSK businesses.

Are you willing to accept the deal? Is the offer price reasonable or fair?

How about whether the major shareholders willing to sell at this price?

I think you know the answer as very smart investors.

Obviously it's still cheap and undervalue even it's at RM 1.50 per share in which the adjusted PE about 8 and NTA RM 2.3 with an equity value of more than RM 4.85 billion.

So, at what price is most of the small shareholders willing to sell?

Based on a normal market movement and simple statistical calculation of let said normal distribution, about 50% of the small shareholders will sell at a price of RM 1.6, about 84% the small shareholders will sell at RM 1.83 and about 97% will sell at RM 2.06. Only remain about 2% will sell at RM 2.3 and 0.1% will sell if offer more than RM 2.3.

At what price will you likely to buy or sell then?

How about the major shareholder???, at what price should OSK Holding Berhad worthy?

How about the third parties willingness to pay a full acquisition offer of premium offer price of RM 2.30 per share of about a capital purchased RM 4.8 billions cash to own the whole OSK businesses?

Accept or deal?

Again as very smart investors, I think you know the answer.

How about at RM 3 offer of RM 6.285 billions in cash?

Look attractive right??? with a PE of 16, maybe reasonable, but also possible normally in businesses full acquisition with 1.5 x of NTA of RM 3.45 offer of RM 7.2 billions in cash that the major shareholder will laugh at you and say thank you and will look into the offer and give you an answer later.

What say you?

Hello, I would like to appreciate your work. It’s a great platform got to learn a lot. Your data is really worthy. Thank you so much. Keep it up!

ReplyDeleteForex Trading

Forex Market

Forex

Foreign Exchange Market

Nice Article. Thank you for sharing the informative article with us.

ReplyDeleteequity shareholders

tax in india

It is really quality & outstanding post. keep it up!

ReplyDeleteLatest stock market news and updates on the stockinvestor...buy or sell stock ideas by experts for minute to minute updates...

Currency Trading

Stock Trading

Demat Account

Share Trading

Great Information! Its looking Nice.Useful for me to develop my knowledge. Thank you!

ReplyDeleteYou can invest in stocks yourself by buying individual Stocks & Shares or mutual funds,IPOs, or get help investing in stocks by Visit stockinvestor.in

Equity Trading

Currency Trading

Demat Account

ShareTrading

It is really quality & outstanding post. keep it up!

ReplyDeleteLatest stock market news and updates on the stockinvestor...buy or sell stock ideas by experts for minute to minute updates...

StockTrading

Stock Trading

Share Trading

Share Trading

Thanks for such a valuable and informative platform I find here.

ReplyDeletewish to learn more about stock market and stock/share market Live Updates from this site (stockinvestor.in)

lic housing finance share price target

tata power stock recommendation

amarraja batteries

jm financial share

phillips carbon share price

balrampur chini mills

relaxo chappals

bioscon ltd

Nice info!Useful post for everyone. Thanks for sharing.

ReplyDeleteStocks and Shares

Unified Payments Interface

SBI Cards and Payments Services

Tata Consultancy Services Limited