5 Cards of OSK Holdings Berhad

Regarding OSK Holdings Berhad, there are actually many shareholders who invest. In 2018, there are more than 24 thousand shareholders, 5 major shareholders hold 52%, 892 shareholders hold about 36.9%, and other 20 plus thousand shareholders hold about 11% of the shares.

But if you want to invest in OSK, you find that you can't look at OSK with fundamental analysis or technical analysis. Therefore, many "experts" or senior investors are not willing to comment much on this stock, because the OSK's trend is completely unreasonable, it is difficult to say anything of prediction. Another thing is the OSK boss seems to be reluctant to spend a penny on analysts, so there have been no analysis reports for many years. So how do you see the OSK? It’s only the OSK boss who knows himself.

If you are an OSK boss, how do you look at the OSK business? Then you have to look at the report.

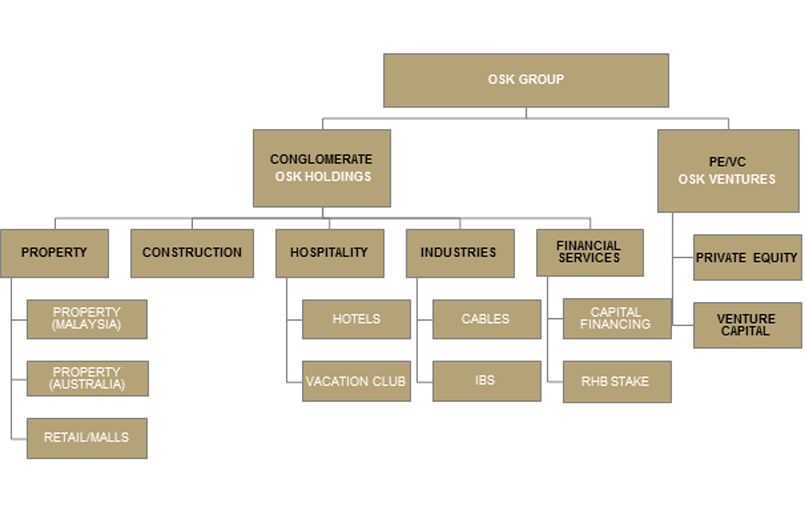

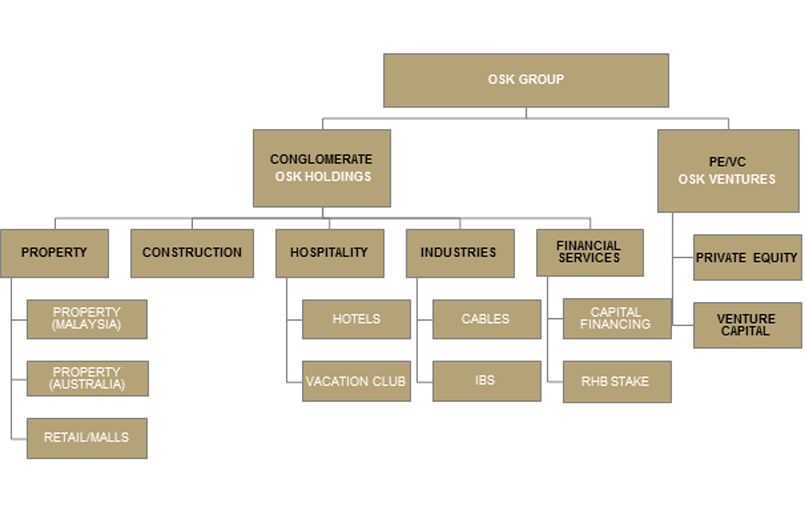

First, what are the cards in the OSK business? Everyone knows that OSK has five cards. There are two big cards and three small cards.

The Big Financial Services Card

The biggest card is financial services and investment holding, with a net asset value of RM 2.567 Billion. RM 1.97 Billion. Far more than the market value of OSK. Many people just saw this big card and drooled. Mainly with owned of 10.13% RHB bank, Malaysia's fourth largest bank, the largest investment bank, the recent business is getting better and better, the profit rate is about 29%, super good income, give good dividends, the boss is very happy. 26% growth in the second quarter. This card is with net worth about RM 1.23 per share. This is the cash machine for OSK!

The Big Property Card

The second big name is the OSK industry, which is the main business. The net asset value is RM2.033 Billion, or again exceeds the current market value of OSK itself. With unbilled sales of RM1.62 billion. When the development of business in various industries is difficult, the OSK industry has quietly become the most profitable industrial company in Malaysia. The profit margin is about 20%. The second quarter results grew by 90%. In this way, the properties industry stocks that grow at this time are only OSK. This card also has a joint development project with EPF in overseas Australian industries. Two new projects with a total value of RM271.57 million will also be launched in the second half of the year. This card is worth about RM0.97. It is an industry share that many former PJD shareholders have never forgotten.

The Industries Card

The third card is industries, mainly cable production and industrialised building system. The net asset value is approximately RM 185 million. Have considerable potential. Provide some income and industrial development materials for OSK. The net value of this card is about RM 0.09, but the income and profit provided are not small. There is a possibility of going public in the future.

The Hospitality Card

The fourth card is the hospitality. Although it is currently a loss-making business. However, the net asset value is about RM 0.06, which is the possibility that the one-off sale of the industry that can be sold can be redeemed. Or maybe the partnership with Hilton to transform the business may work.

The Construction Card

The last card is the construction. Although it is currently a negative net asset, it still provides a small profit and provides value to the OSK industry. It is also a card for the development of potential construction business.

The Business Growth & Values

In fact, this business, as far as the current market price seems to be like for cheap sale, after seeing five cards, the business is booming, and the market price will still fall? What's more, the market value of OSK has been falling in the past five years. If you want to buy a discount, you should buy some. Just buy a business and sit with the Boss Tan Sri Ong to see what pattern he has?

In addition, if you buy OSK at the current ultra-low price, or if you already have an OSK investor, you may only be able to see as to buy a business instead of a stock and treat yourself like a boss. You can only wait for the business to be a good price to buy or sell. It's not as easy to analyze this stocks to decide to buy or sell. This business, the future potential is good, the dividend is about 5.41%, the net asset value is RM 2.30, the PE is less than 5.. It is really a big lobster jumping around the road side....

This is just my two sen opinion, and there are many opinions that require a lot of guidance.

But if you want to invest in OSK, you find that you can't look at OSK with fundamental analysis or technical analysis. Therefore, many "experts" or senior investors are not willing to comment much on this stock, because the OSK's trend is completely unreasonable, it is difficult to say anything of prediction. Another thing is the OSK boss seems to be reluctant to spend a penny on analysts, so there have been no analysis reports for many years. So how do you see the OSK? It’s only the OSK boss who knows himself.

If you are an OSK boss, how do you look at the OSK business? Then you have to look at the report.

First, what are the cards in the OSK business? Everyone knows that OSK has five cards. There are two big cards and three small cards.

The Big Financial Services Card

The biggest card is financial services and investment holding, with a net asset value of RM 2.567 Billion. RM 1.97 Billion. Far more than the market value of OSK. Many people just saw this big card and drooled. Mainly with owned of 10.13% RHB bank, Malaysia's fourth largest bank, the largest investment bank, the recent business is getting better and better, the profit rate is about 29%, super good income, give good dividends, the boss is very happy. 26% growth in the second quarter. This card is with net worth about RM 1.23 per share. This is the cash machine for OSK!

The Big Property Card

The second big name is the OSK industry, which is the main business. The net asset value is RM2.033 Billion, or again exceeds the current market value of OSK itself. With unbilled sales of RM1.62 billion. When the development of business in various industries is difficult, the OSK industry has quietly become the most profitable industrial company in Malaysia. The profit margin is about 20%. The second quarter results grew by 90%. In this way, the properties industry stocks that grow at this time are only OSK. This card also has a joint development project with EPF in overseas Australian industries. Two new projects with a total value of RM271.57 million will also be launched in the second half of the year. This card is worth about RM0.97. It is an industry share that many former PJD shareholders have never forgotten.

The Industries Card

The third card is industries, mainly cable production and industrialised building system. The net asset value is approximately RM 185 million. Have considerable potential. Provide some income and industrial development materials for OSK. The net value of this card is about RM 0.09, but the income and profit provided are not small. There is a possibility of going public in the future.

The Hospitality Card

The fourth card is the hospitality. Although it is currently a loss-making business. However, the net asset value is about RM 0.06, which is the possibility that the one-off sale of the industry that can be sold can be redeemed. Or maybe the partnership with Hilton to transform the business may work.

The Construction Card

The last card is the construction. Although it is currently a negative net asset, it still provides a small profit and provides value to the OSK industry. It is also a card for the development of potential construction business.

The Business Growth & Values

In fact, this business, as far as the current market price seems to be like for cheap sale, after seeing five cards, the business is booming, and the market price will still fall? What's more, the market value of OSK has been falling in the past five years. If you want to buy a discount, you should buy some. Just buy a business and sit with the Boss Tan Sri Ong to see what pattern he has?

In addition, if you buy OSK at the current ultra-low price, or if you already have an OSK investor, you may only be able to see as to buy a business instead of a stock and treat yourself like a boss. You can only wait for the business to be a good price to buy or sell. It's not as easy to analyze this stocks to decide to buy or sell. This business, the future potential is good, the dividend is about 5.41%, the net asset value is RM 2.30, the PE is less than 5.. It is really a big lobster jumping around the road side....

This is just my two sen opinion, and there are many opinions that require a lot of guidance.

It's very interesting, Thanks for sharing a valuable information to us & Knowledgeable also, keep on sharing like this.

ReplyDeleteStock Investor provides leatest Indian stock market news and Live BSE/NSE Sensex & Nifty updates.Find the relevant updates regarding Buy & Sell....

Online Trading

Currency Trading

Equity Trading

Stock Trading

Trading

Online Trading

Nice Article. Thank you for sharing the informative article with us.

ReplyDeleteThis post is helpful to many people. stockinvestor.in is a stock related website which provides all stocks related information like new stocks and shares available in the stock market.

equity shareholders

tax in india

It is really quality & outstanding post. keep it up!

ReplyDeleteLatest stock market news and updates on the stockinvestor...buy or sell stock ideas by experts for minute to minute updates...

Currency Trading

Stock Trading

Demat Account

Share Trading

Great Information! Its looking Nice.Useful for me to develop my knowledge. Thank you!

ReplyDeleteYou can invest in stocks yourself by buying individual Stocks & Shares or mutual funds,IPOs, or get help investing in stocks by Visit stockinvestor.in

Equity Trading

Currency Trading

Demat Account

ShareTrading

It is really quality & outstanding post. keep it up!

ReplyDeleteLatest stock market news and updates on the stockinvestor...buy or sell stock ideas by experts for minute to minute updates...

StockTrading

Stock Trading

Share Trading

Share Trading

It is really quality & outstanding post. keep it up!

ReplyDeleteLatest stock market news and updates on the stockinvestor...buy or sell stock ideas by experts for minute to minute updates...

StockTrading

Stock Trading

Share Trading

Share Trading

It is really quality & outstanding post. keep it up!

ReplyDeleteLatest stock market news and updates on the stockinvestor...buy or sell stock ideas by experts for minute to minute updates...

StockTrading

Stock Trading

Share Trading

Share Trading

It is really quality & outstanding post. keep it up!

ReplyDeleteLatest stock market news and updates on the stockinvestor...buy or sell stock ideas by experts for minute to minute updates...

StockTrading

Stock Trading

Share Trading

Share Trading

Great Information! Its looking Nice.....

ReplyDeleteYou can invest in stocks yourself by buying individual Stocks & Shares or mutual funds,IPOs, or get help investing in stocks by Visit stockinvestor.in

phillips carbon share price

shakti pumps share price

ramco industries

mahindra amc

bajaj electricals share price

kolte patil developers ltd

sbi insurance

bsesensex

Thanks for such a valuable and informative platform I find here.

ReplyDeletewish to learn more about stock market and stock/share market Live Updates from this site (stockinvestor.in)

lic housing finance share price target

tata power stock recommendation

amarraja batteries

jm financial share

phillips carbon share price

balrampur chini mills

relaxo chappals

bioscon ltd

Good Information. I have a question regard the stocks. Which is

ReplyDeleteI keep hearing it’s crucial to be diversified. Why?

glen india

what is stock market

marksans pharma news

colgate palmolive share price bse

top gainers today

v guard

stock recommendations for short term

type of share market

Thanks. I am regularly following you. Your posts always contain some good information and your way of explanations is very very good. See marksans pharma news

ReplyDelete